ANALYSIS: What Meta’s $2B Manus Buy Signals for Leaders in 2026

The $2 Billion Deal That Shows Where AI Competition Is Headed (Guest)

TL;DR: Meta acquired Manus, an autonomous AI agent startup, for over $2 billion. Manus completes entire projects autonomously and was generating over $100 million annually before acquisition. The deal signals AI competition is shifting from chatbots to autonomous agent systems, with tech giants committing over $560 billion to AI infrastructure in 2025.

The AI race just changed speed in 2026, and most leaders aren’t paying attention yet to what is the most consequential push in tech this decade.

For two years, OpenAI dominated with ChatGPT. Then Google’s Gemini and Anthropic’s Claude caught up (Claude is my go-to LLM). What looked like a one-company show became a three-way race almost overnight. Now Meta wants in, and they just spent over $2 billion in 10 days to buy their way to the starting line.

But Meta’s move is just one piece of a much bigger story.

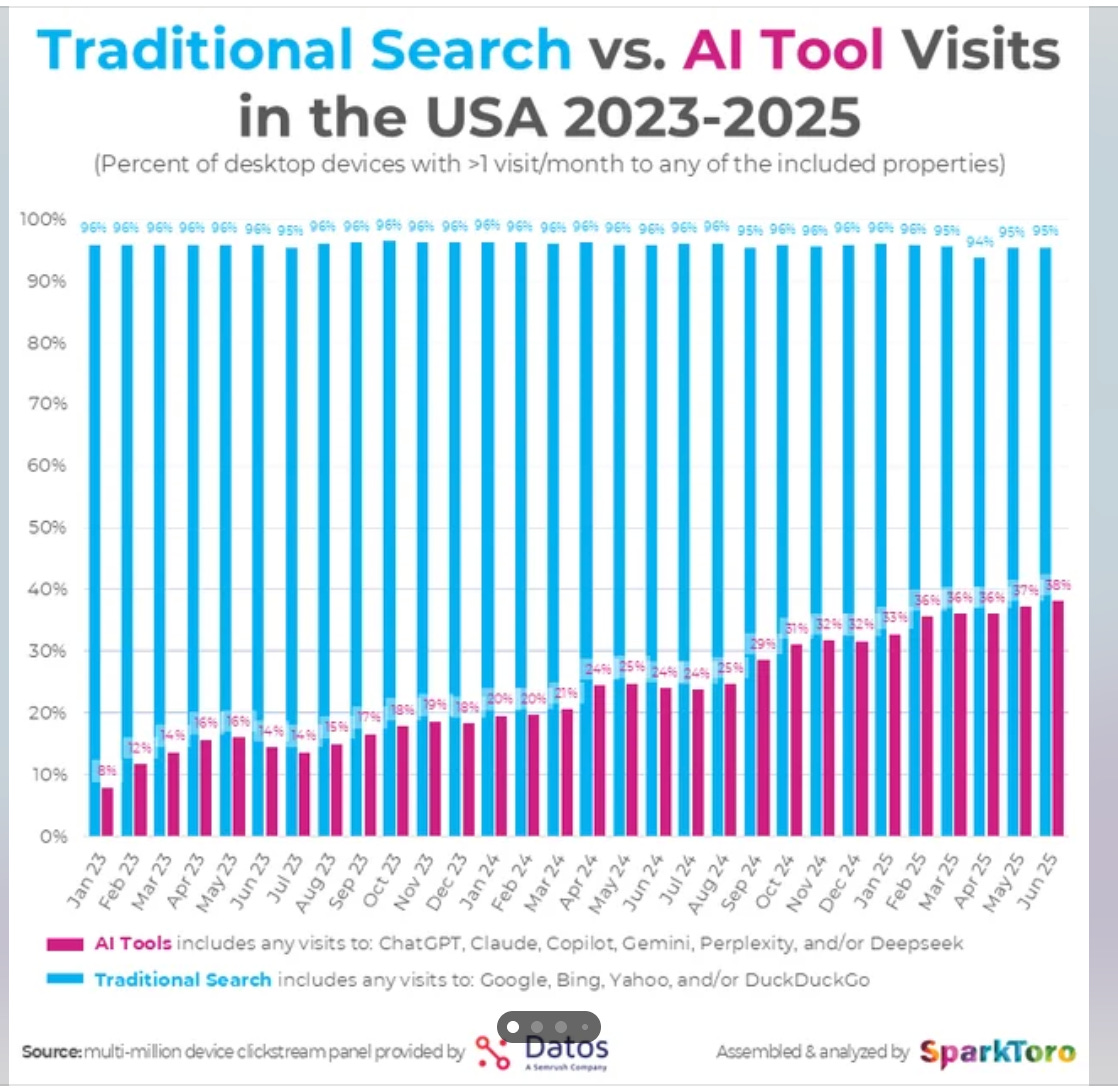

Look at this chart from SparkToro’s recent research:

In January 2023, only 8% of desktop users visited AI tools monthly. By June 2025, that number hit 39%. Meanwhile, traditional search stayed flat at around 95%. That’s not people experimenting. That’s people switching their habits.

When nearly 40% of users have already adopted AI tools in just 30 months, the companies that control those tools gain enormous influence over how work gets done. And tech giants know it. In 2025 alone, they committed over $560 billion to AI deals and infrastructure. Google spent $32 billion acquiring cloud security firm Wiz. SoftBank invested $4 billion to control data center infrastructure. Disney put $1 billion into OpenAI. The US government took an $8.9 billion stake in Intel to secure domestic chip manufacturing.

These companies aren’t spending this money because they love AI. They’re spending it because they see what’s coming, and they’re racing to control it before their competitors do.

Why This Matters to You

Here’s the part most leaders miss: you won’t get to choose whether AI becomes part of your workflow. That choice is being made for you right now.

If your company uses Microsoft tools (Word, Excel, Outlook, Teams), you’re getting Copilot whether you want it or not.

If your organization runs on Google Workspace (Gmail, Docs, Sheets, Drive), Gemini is coming.

If you’re on Meta’s platforms (Facebook, Instagram, WhatsApp) for marketing or communication, their AI will soon handle tasks you currently do manually.

The question isn’t whether AI will change your work. The question is which company’s AI will be making those changes, and whether you’ll understand what’s happening in time to guide it strategically.

That’s why Meta’s Manus acquisition matters. It signals where this race is headed: away from chatbots that answer questions, toward AI systems that complete entire projects autonomously. And 2026 will see this pattern accelerate as companies fight to either break into the top tier or defend their position.

What Is Manus?

Before we go deeper, watch this quick explainer on what makes Manus different:

Manus isn’t another chatbot, as you’ll learn below.

The company was generating over $100 million per year with millions of paying customers before Meta acquired it. Meta paid $2 billion for that capability because they couldn’t build it fast enough internally.

To understand exactly what Meta bought and why it matters, I want to introduce someone who can explain this clearly and brilliantly, Farida Khalaf.

Farida Khalaf writes Lights On by Farida, one of the most creative voices on Substack covering cybersecurity and AI. She brings technical depth in data engineering and cybersecurity with storytelling that makes complex topics accessible. When the Manus acquisition broke, I immediately thought of her because she’s been tracking autonomous agent development closely.

What follows is Farida’s analysis of what Manus actually is, why Meta paid what they paid, and how it compares to what OpenAI and Google are building.

Here is Farida…

Meta Acquires Manus: Inside the $2 Billion Deal That Could Reshape AI

Meta just made one of the boldest moves in the AI race, and it cost them over $2 billion. Here’s why Manus was worth every penny.

The Deal

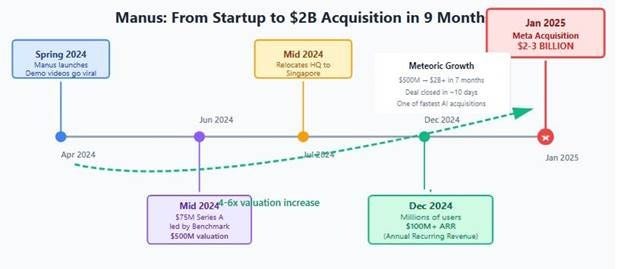

Meta announced it has acquired Manus, a Singapore-based AI startup that builds autonomous general-purpose AI agents. While Meta hasn’t officially disclosed the price, sources including the Wall Street Journal report the deal closed at over $2 billion, roughly 4-6x the company’s $500 million valuation just seven months earlier.

The deal was struck in about 10 days, unusually fast for a transaction of this size. For Mark Zuckerberg, who has staked Meta’s future on AI, this represents something new: an AI product that’s actually making money. Manus reported over $100 million in annual recurring revenue and millions of users before the acquisition.

What Is Manus?

Manus isn’t just another chatbot. It’s a fundamentally different kind of AI system.

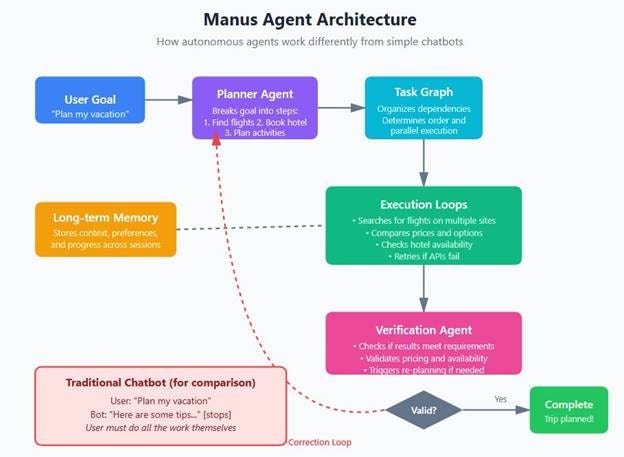

Unlike ChatGPT that waits for your next instruction, Manus takes your goal and runs with it, planning, executing, and delivering complete work products from start to finish. Think of it as the difference between a helpful assistant who answers questions and an employee who completes entire projects autonomously.

The Technical Architecture

Manus employs a multi-agent architecture with specialized modules: a Planner Agent breaks problems into manageable sub-tasks, an Execution Agent carries out the plan by interacting with external systems, and a Verification Agent checks results and triggers re-planning if needed.

The system has access to a server-side shell, web browser, file system, and programming interpreters. It can launch web servers and expose them to the internet. All of this happens server-side, meaning Manus continues working even when your device is off.

Manus proceeds through chains of tool uses with explicit planning layers, persistent execution loops, task graphs rather than linear chains, long-term memory that survives across sessions, and native tool orchestration. This isn’t an LLM with tools bolted on—it’s an operating system for autonomous agents.

Why Did Meta Pay $2 Billion?

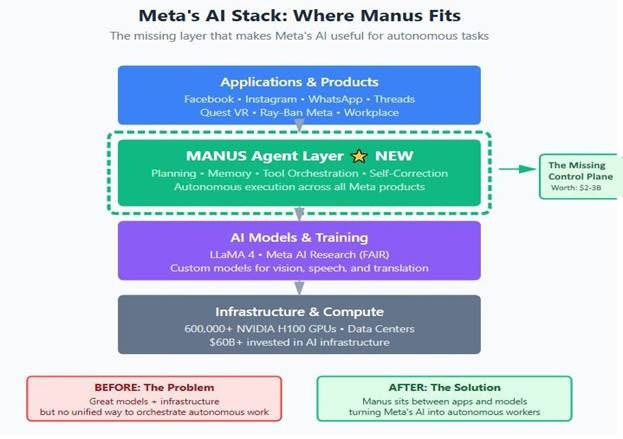

Meta isn’t struggling with AI talent or compute power. The company has world-class researchers, massive data centers, and the LLaMA model family. So why spend $2 billion on a startup?

The Execution Gap

Meta excels at research and scale but has historically struggled turning research into tight, opinionated products that ship fast. Manus solved exactly what Meta needed: a proven, production-grade agent system that already works at scale.

As one analyst described it, the acquisition gives Meta’s platforms “a brain transplant.” Meta wasn’t buying intelligence—it was buying a complete execution framework and speed to market.

The Agent Layer Is the New Platform

The next AI race isn’t about who has the smartest model, it’s about who controls the agent layer that sits on top of those models. Enterprise software companies like Salesforce and ServiceNow are heavily promoting agents as the most effective way for businesses to use AI, rather than simple chatbots.

Manus already crossed that threshold with a system integrating planning, memory, tool orchestration, and self-correction. For Meta, $2 billion is less than a year of AI infrastructure spending. The alternative, spending 2-3 years building this internally while competitors define the agent standard, represented far greater risk.

Revenue From Day One

Unlike most AI investments promising future returns, Manus generated over $100 million in annual recurring revenue by selling subscriptions to businesses. This gives Meta immediate ROI at a time when investors have grown concerned about the company’s $60+ billion AI infrastructure spending.

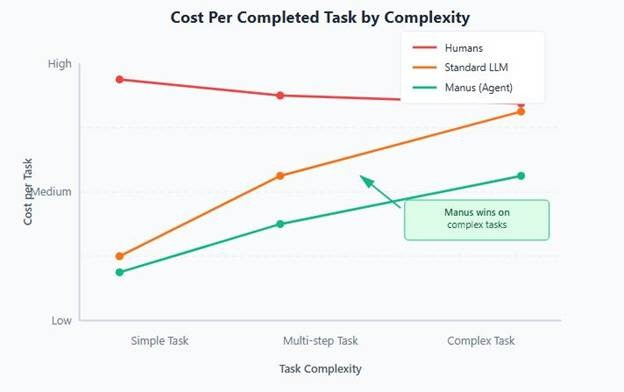

Agent systems like Manus make multiple model calls, implement planning and execution loops, and include retries and self-corrections. This means higher per-task inference costs than a single LLM call.

However, the cost per completed outcome is often lower because the agent finishes jobs without human intervention or restarts. Meta doesn’t care about cost per token, they care about cost per completed goal. That’s where agent systems win.

Manus’s architecture provides another advantage: instead of stuffing everything into one giant reasoning prompt, it decomposes reasoning into steps, uses lightweight reasoning most of the time, and escalates to heavier reasoning only when needed. This distributed approach is cheaper at scale.

Regarding hallucinations, Manus-style agents verify outputs with tools, check intermediate steps, and retry when results fail constraints. This doesn’t eliminate hallucinations but contains them through automatic failure recovery, far easier to manage than raw LLM output.

The Competitive Landscape

OpenAI’s Approach

OpenAI launched Operator in January 2025, powered by a Computer-Using Agent model combining GPT-4o’s vision with reinforcement learning. Their ChatGPT agent reaches 27.4% accuracy on the challenging FrontierMath benchmark. However, GPT-4o scored 0% on end-to-end autonomous replication tasks, suggesting OpenAI’s capabilities remain more research-oriented than production-ready.

Key difference: OpenAI has cutting-edge models but is still building the agent infrastructure. Manus shipped a production system first.

Google’s Strategy

Google introduced Project Astra and Gemini 2.0, betting heavily on “the agentic era.” Project Mariner achieved 83.5% on the WebVoyager benchmark for web tasks. Their technical foundation is impressive, with multimodal synchronicity and sub-300ms latency.

Key difference: Google has world-class research and ambitious prototypes, but Astra remains in trusted tester programs. Manus has millions of paying users today.

The Revenue Gap

Manus: $100M+ ARR, millions of users, profitable

OpenAI agents: Research preview, no standalone revenue

Google Astra: Not commercially available

Manus solved the productization problem that big labs are still working on.

Navigating the Geopolitical Minefield

The Manus acquisition required surgical precision to execute. The company’s parent, Butterfly Effect, was founded in Beijing in 2022 by Chinese entrepreneurs and backed by Tencent, ZhenFund, and HongShan (formerly Sequoia China).

The Strategic Pivot

In May 2024, Manus relocated headquarters from Beijing to Singapore. By July, Butterfly Effect had shut down its entire China team to reduce geopolitical risks. The company then opened offices in San Mateo and Tokyo, deliberately building a multinational presence.

Meta’s Non-Negotiable Conditions

To clear regulatory hurdles, Meta imposed strict terms: complete buyout of all Chinese investors, discontinuation of all China operations, and zero continuing Chinese ownership interests after closing.

The Committee on Foreign Investment in the United States (CFIUS) represents the deal’s most significant remaining hurdle. US Senator John Cornyn previously criticized Benchmark’s investment in Manus as American capital subsidizing a core adversary in AI. Analysts warn that Manus has “infinitely more capability to harvest information” than TikTok given its autonomous nature.

Meta moved fast, finalizing the entire transaction in approximately 10 days, likely to secure the acquisition before the regulatory climate shifted.

Real-World Use Cases

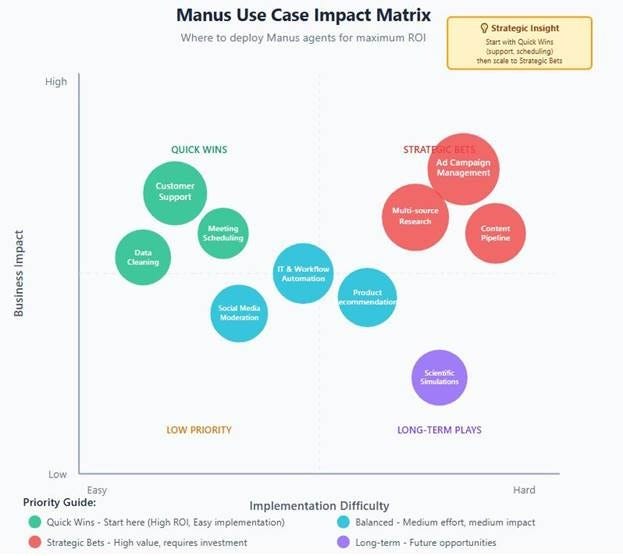

Manus excels at tasks that are long, branching, repetitive, and prone to failure. Here are the highest-impact applications:

Quick Wins (High Impact, Easy Implementation):

Customer support triage - Reduces headcount while increasing speed

Data cleaning and validation - Minimizes data engineer hours

Meeting scheduling - Replaces manual coordination

Strategic Bets (High Impact, Complex Implementation):

Ad campaign management - Real-time optimization at scale

Multi-source research reports - Autonomous data gathering and synthesis

Content creation pipelines - Automated draft-to-final workflows

Balanced Opportunities:

IT and workflow automation - Reduced monitoring staff

Social media moderation - Faster review cycles

Product recommendations - Autonomous testing and updates

What This Means for You

For Businesses

Don’t wait. Manus continues as a standalone service while Meta integrates the technology. The acquisition actually reduces risk, you get Meta’s resources backing continued development. Start experimenting now with customer support, research reports, or data processing.

For Developers

Key lessons from Manus’s architecture: Production reliability beats theoretical elegance. Make opinionated design choices rather than building infinitely flexible systems. Treat memory and tool orchestration as first-class concerns. Focus on one narrow use case and perfect it before expanding.

For Investors

The Manus deal establishes a valuation framework: proven agent systems with real revenue command 20-30x revenue multiples. Companies to watch: Adept AI ($415M raised), Cognition AI (Devin), Lindy AI, and Relevance AI. Strategic acquirers likely include Microsoft, Salesforce, Amazon, and Apple.

The Bottom Line

Meta didn’t pay $2 billion for a better language model or more AI talent. The company paid for a proven system that turns AI models into autonomous workers, along with the execution speed and decisiveness that comes from startup culture.

This acquisition is about controlling the agent layer, the operating system that will sit on top of AI models and define how billions of people interact with autonomous AI. The question now isn’t whether autonomous agents will transform how we work; it’s which company will control that transformation.

With this move, Meta is betting it won’t be left behind.

FINAL THOUGHTS: The Real Strategic Play: Market Power Over Technology

Meta’s acquisition of Manus isn’t about AI innovation, it’s about market position and power Instagram ($1B), WhatsApp ($19B), Oculus ($2B), Meta’s playbook is horizontal acquisitions to control distribution and eliminate competition.

Manus follows this pattern: neutralize threats before they become serious competitors.

Meta doesn’t build, it buys market share. Instagram threatened mobile social, Meta bought it. WhatsApp threatened messaging, Meta bought it. Now autonomous AI agents threaten to become the primary digital interface, so Meta bought Manus This is market defense, not technology acquisition. The threat isn’t that competitors will build better agents, it’s that they’ll own the user interface for the next computing paradigm.

Why Distribution Wins

LLM investment yields diminishing returns at exploding costs. Meta’s $60B+ AI spending needs cash flow. Manus produces $100M+ annually and provides a monetizable product Meta can push through Instagram, Facebook, and WhatsApp, instant distribution to billions. Same playbook as Instagram and WhatsApp: acquire, integrate, monetize.

Meta will aggressively integrate Manus, especially on Instagram, to capture Gen Z and Gen Alpha. These users will grow up with Manus as their default AI agent, locked into Meta’s ecosystem. Data centers power agents, social graphs personalize, payment rails monetize.

Meta isn’t competing on smartest AI, they’re competing on user access control.

Their distribution advantage is nearly insurmountable. Expect aggressive marketing positioning Manus as the everyday AI agent. Meta will compete with Google (Astra) and Anthropic (Claude) for market share and platform lock-in. While competitors chase technology, Meta pursues ubiquity. The goal: most-used agent, not best agent.

The Brutal Lesson

Strategic positioning trumps technological superiority.

Meta bought a revenue-generating product with distribution potential, not breakthrough technology. This is market share acquisition disguised as a tech deal, horizontal expansion to maintain dominance.

Power preservation, not innovation.

The real question for competitors: “Can we compete with Meta’s distribution empire?” Most lose that battle before they start.The Manus acquisition represents one of the largest AI deals of 2025 and sets a new benchmark for how tech giants value proven autonomous AI systems over pure research potential.

References

[1] OpenAI Operator FrontierMath Benchmark Performance -https://openai.com/operator/ [2] OpenAI GPT-4o End-to-End Autonomous Task Performance -https://openai.com/research/gpt-4o/ [3] Google Project Mariner WebVoyager Benchmark Results -https://deepmind.google/technologies/project-mariner/

Thank you, Farida!

Why 2026 Will Accelerate This Race

The pattern is clear. In 2025, tech giants spent over $560 billion positioning themselves for what comes next. They’re not making 2-year bets. They’re making 10-year bets on who will control how billions of people work with AI.

As Farida explained, Meta didn’t just buy technology. They bought execution capability, proven revenue, and speed to market.

That’s the playbook now: buy what works instead of spending years building internally while competitors pull ahead.

Google did the same thing, paying $2.4 billion to extract Windsurf’s CEO and engineering team. Nvidia grabbed Groq’s founder and key engineers. Disney invested $1 billion in OpenAI rather than developing video generation in-house. When the landscape shifts this fast, building internally means falling behind.

Look at that chart again. AI tool adoption jumped from 8% to 39% in 30 months. As that number climbs toward 50%, 60%, 70%, the companies that control those tools will define how work gets done. They’ll capture the workflow habits. They’ll own the switching costs. They’ll determine which tasks get automated and which stay human.

That’s why I expect 2026 to see even more aggressive moves. The gap between AI leaders and everyone else is widening.

What This Means for Mission-Driven Leaders

You’re already in this race whether you know it or not. The tools you use every day are being rebuilt with AI at the center.

The leaders who understand this shift have an 18-24 month window to learn how these systems work, test them in low-risk environments, and develop organizational knowledge before AI becomes ubiquitous.

To help, I’m launching a consulting opportunity for those interested in a deepdive into their systems. Book a free consultation.

What platform does your organization depend on most, and have you tested its AI capabilities yet?

Partner and Connect

I love connecting with people. Please use the following connect, collaborate, if you have an idea, or just want to engage further:

LinkedIn / Community Chat / Email / Medium

Great breakdown!

Will be interesting to see where this lands in Meta's portfolio on the Whatsapp to metaverse scale

This was a pretty awesome read. The charts of people using AI for search are mind-blowing but not at all surprising. Using AI to create content is one thing. Using it to streamline how efficiently you operate is the next level up.

And as somebody who helps people build brands and operating systems, this acquisition makes Manus a very attractive option.

Thanks for the great write-up