AI Bubble? Here is the data... you decide

The well-researched case for and against an AI market correction

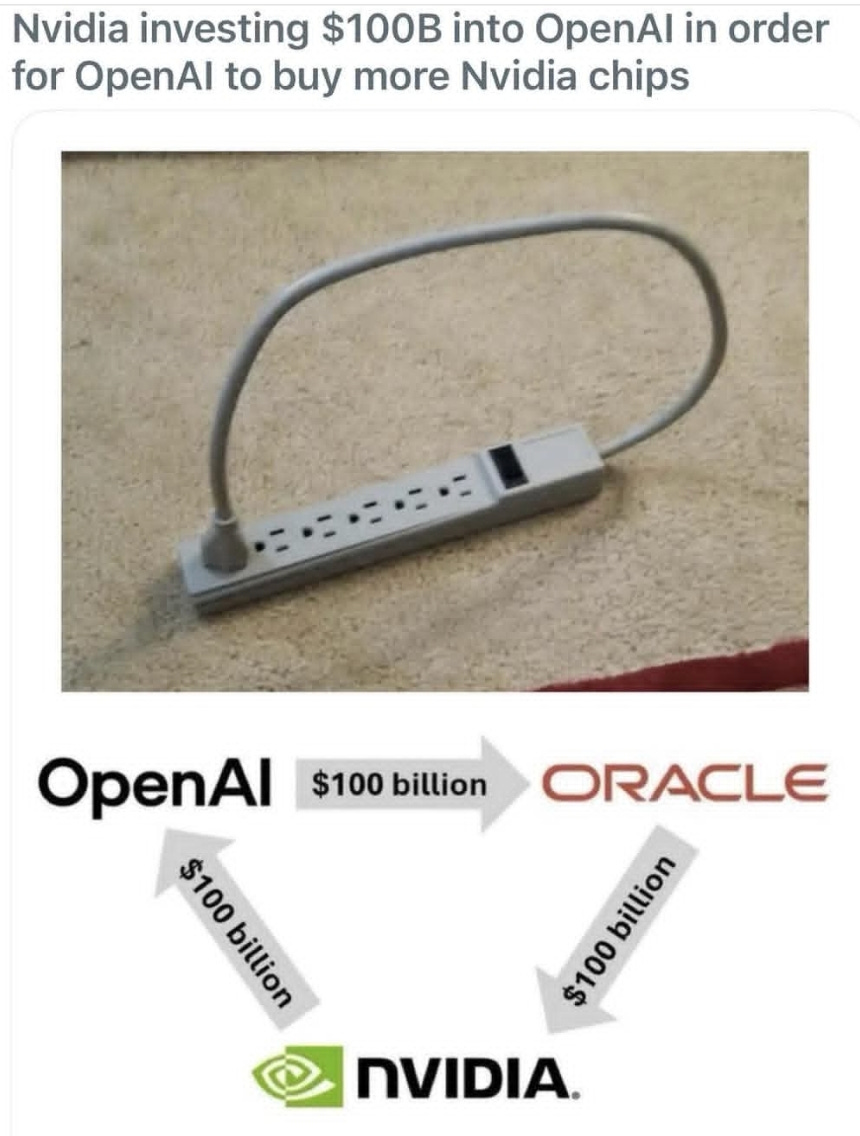

The AI Bubble is coming!!! I’ve had the same conversation about six times in the past month, followed by memes like this one…

Someone brings up AI, usually in the context of their company, their strategy, or just trying to make sense of the headlines, and within two minutes, the question comes up: “So... is this whole AI thing about to crash?”

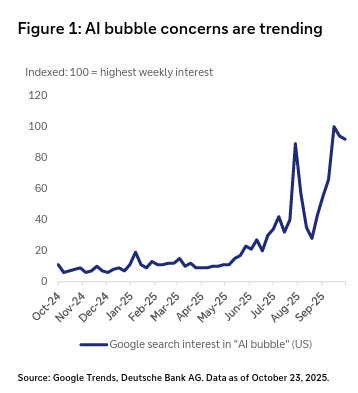

It’s a fair question. Google searches for “AI bubble” just hit an all-time high. Some analysts are predicting a 2026 correction that wipes out 40-60% of AI company valuations. Others are saying we’re not in a bubble at all. We’re just watching the messy, expensive middle of a massive economic shift.

Here’s what I’m not going to do: tell you which side is right. At least, not yet.

Instead, I wanted to do something more useful. I’m going to lay out both arguments as clearly as I can. One that says yes, the AI bubble is real and it’s going to pop, and one that says no, this is just a rotation, not a collapse. Then you can decide what you actually think.

Let me define what I mean by “bubble pop” for this debate: A sustained market correction of 20% or more from recent highs in the technology sector, specifically affecting companies whose core value proposition depends on AI. Not a temporary dip. A real reset that forces everyone to recalculate what AI is worth.

Before we go further, I’m curious what you think right now:

For this debate, I’m taking the “yes, bubble” side. I’ll show you the data on the gap between what companies are spending on AI versus what they’re actually making, the valuations that look historically unsustainable, and the technical limits that could trigger a market reset.

Full transparency: I’m arguing this side for the sake of the debate. You won’t know what I actually believe until the conclusion.

Taking the other side is Laura Ferraz Baick, Head of Marketing at Impressive. Laura writes weekly on AI, growth, and building conscious businesses in this new economy. Her argument: 2026 isn’t a bubble pop, it’s an “AI hangover and rotation.” She believes AI is too embedded in how companies actually work to experience a full collapse.

Here’s what you’ll walk away with:

The strongest arguments for why AI markets could correct in 2026

Why some experts think this is just messy growth, not a crash

What the data (search trends, valuations, capital flows) actually shows about risk

A clearer framework for thinking about AI’s trajectory, regardless of market noise

My goal isn’t to tell you there’s a bubble or convince you everything’s fine. It’s to give you both sides clearly enough that you can think through what this means for your organization, your strategy, and how you’re approaching AI.

Let’s start with my case for why the bubble will pop.

Quick sidenote, do you want help building your AI strategy? Auditing your workflows? I help mission-driven leaders implement AI without the tool chaos. Let’s connect!

Joel: YES, THE AI BUBBLE WILL POP

Pillar 1: The Revenue Gap Is Unsustainable

The most uncomfortable fact in AI right now is this: companies are spending historic amounts of money on AI infrastructure while generating a fraction of that in actual revenue.

Sequoia Capital’s David Cahn framed it as the “$600 billion question.” The gap between what’s being spent on AI infrastructure and what the entire AI ecosystem is generating in revenue has grown from $200 billion to $600 billion annually (Sequoia Capital). That’s not a rounding error. That’s a structural problem.

Here’s what that looks like in practice. Big Tech companies are projected to make about $35 billion in total AI revenue in 2025 (Ed Zitron analysis). Meanwhile, global data center capital expenditures surged by over 50% year over year, hitting nearly $500 billion (Deutsche Bank). The math doesn’t work. And according to MIT research, 95% of organizations are currently receiving “zero return” from their generative AI investments (MIT study).

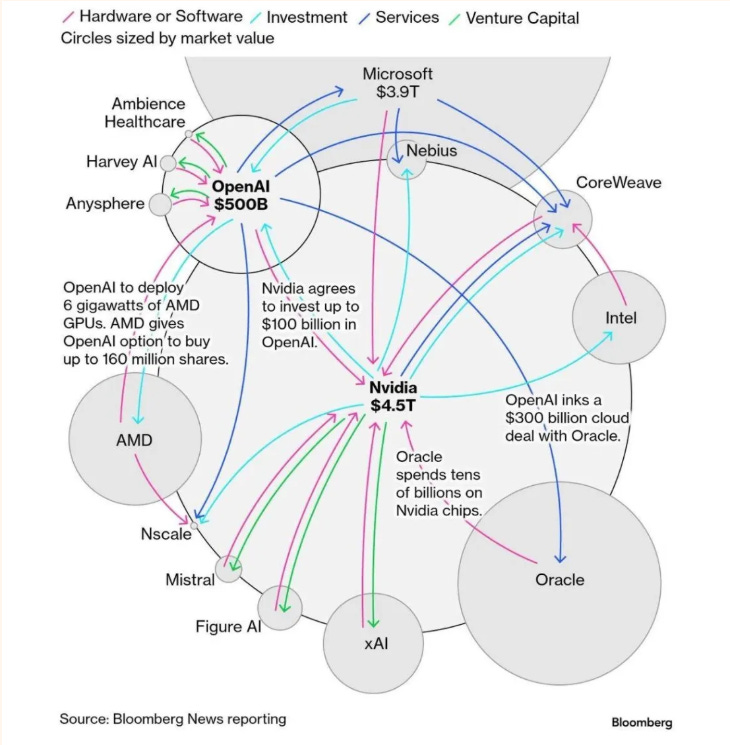

Look at this network. The entire AI economy is extremely concentrated. A small group of companies (Microsoft, Nvidia, OpenAI, Oracle) are both funding each other and depending on each other for revenue. Microsoft invests in OpenAI. OpenAI buys Nvidia chips. Nvidia invests back into the ecosystem. Oracle spends billions on Nvidia infrastructure while also partnering with OpenAI.

This works beautifully when capital is abundant and everyone’s growing. But it’s fragile. You can’t run an economy on promises forever. At some point, revenue has to justify the spending. Right now, it doesn’t. Not even close.

Ready to implement and build with AI? Join Premium for $1,345+ in tools and systems at $39/yr. Start here | Looking for 1-on-1 coaching or a private knowledge hub build? Book a free call.

Pillar 2: Valuations Are at Historically Dangerous Levels

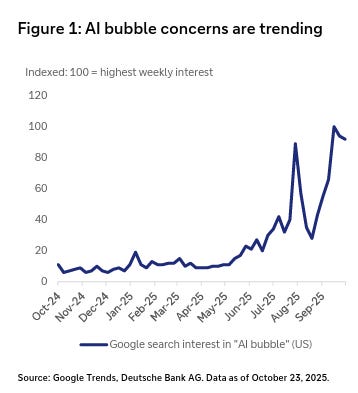

If you’ve felt like everyone’s suddenly talking about an AI bubble, you’re not imagining it.

Google search interest for “AI bubble” has hit an all-time high, with a massive spike through late 2025 (Deutsche Bank / Google Trends). This isn’t just retail investors getting nervous. It’s a signal that even casual observers are starting to notice that AI valuations look disconnected from reality.

And the concern is justified. Leading AI stocks like Nvidia have pushed past a Price-to-Sales ratio of 30 (Nasdaq / The Motley Fool). Historically, that level has been unsustainable for megacap companies.

The last time we saw this pattern at scale, it ended badly.

Pillar 3: The Capital Flow Is About to Dry Up

Even if you believe in AI’s long-term potential, there’s a more immediate problem: the funding model holding this entire ecosystem together is starting to crack.

Venture capital “dry powder” is dropping. Jon Sakoda of Decibel Partners estimates that at the current rate of investment, the industry will run out of money in roughly six quarters, by February 2027 (Decibel Partners / Ed Zitron). That’s not “eventually.” That’s next year.

If any major player pulls back spending, the entire network contracts. Companies that depend on continuous venture funding or hyperscaler spending will struggle to raise more money, go public, or find buyers.

Ed Zitron argues that when this funding dries up, we won’t see one dramatic crash. We’ll see a series of events where AI companies “wither and die” because they can’t raise more capital, can’t reach profitability, and can’t exit.

What This Adds Up To

You can believe in AI’s long-term potential and still recognize that 2026 looks like a correction year. The gap between spending and revenue is unsustainable. Valuations are at historically risky levels. The capital keeping everything afloat is running out faster than expected. And the technology itself is hitting scaling limits that can’t be solved by just spending more money.

That’s not pessimism. That’s math.

Now let me hand this over to Laura Ferraz Baick , who’s going to tell you why I’m wrong.

SECTION 2: NO BUBBLE, JUST ROTATION

Yes, I know you were curious to hear my take.

Since the first famous bubble, tulip mania, people have watched markets with the same nervous instinct: nobody wants to miss the upside, and nobody wants to be the last person holding the bag.

My view is simpler: 2026 is the year the AI market gets less forgiving, not the year the entire category collapses. Prices can reset and a lot of “AI” companies can die. That still doesn’t equal a dot-com-style unwind.

To call it a real bubble pop under Joel’s definition, you’d need a sustained 40–60% peak-to-trough drop across AI-concentrated names, plus a real shift in capital allocation away from AI as a category. I don’t see the conditions for that. The cash flows, contracts, and infrastructure commitments are already too embedded.

Let’s walk through it.

Pillar 1 – Earnings and infrastructure quietly backstop the AI story

If 2023 and 2024 founders built their narratives to raise funds, 2026 looks like receipts: procurement cycles, multi-year cloud commitments, and line items inside products companies already pay for.

That is a huge change of context because “AI spend” is not just the stock price of a few headline companies. It shows up in places that are sticky by default:

Cloud and infrastructure bills

AI features embedded into existing tools

Hardware and data center buildouts that take years to plan

Even when public multiples compress, those infrastructure commitments don’t disappear overnight.

You can see it in the scale of spending that keeps getting committed anyway:

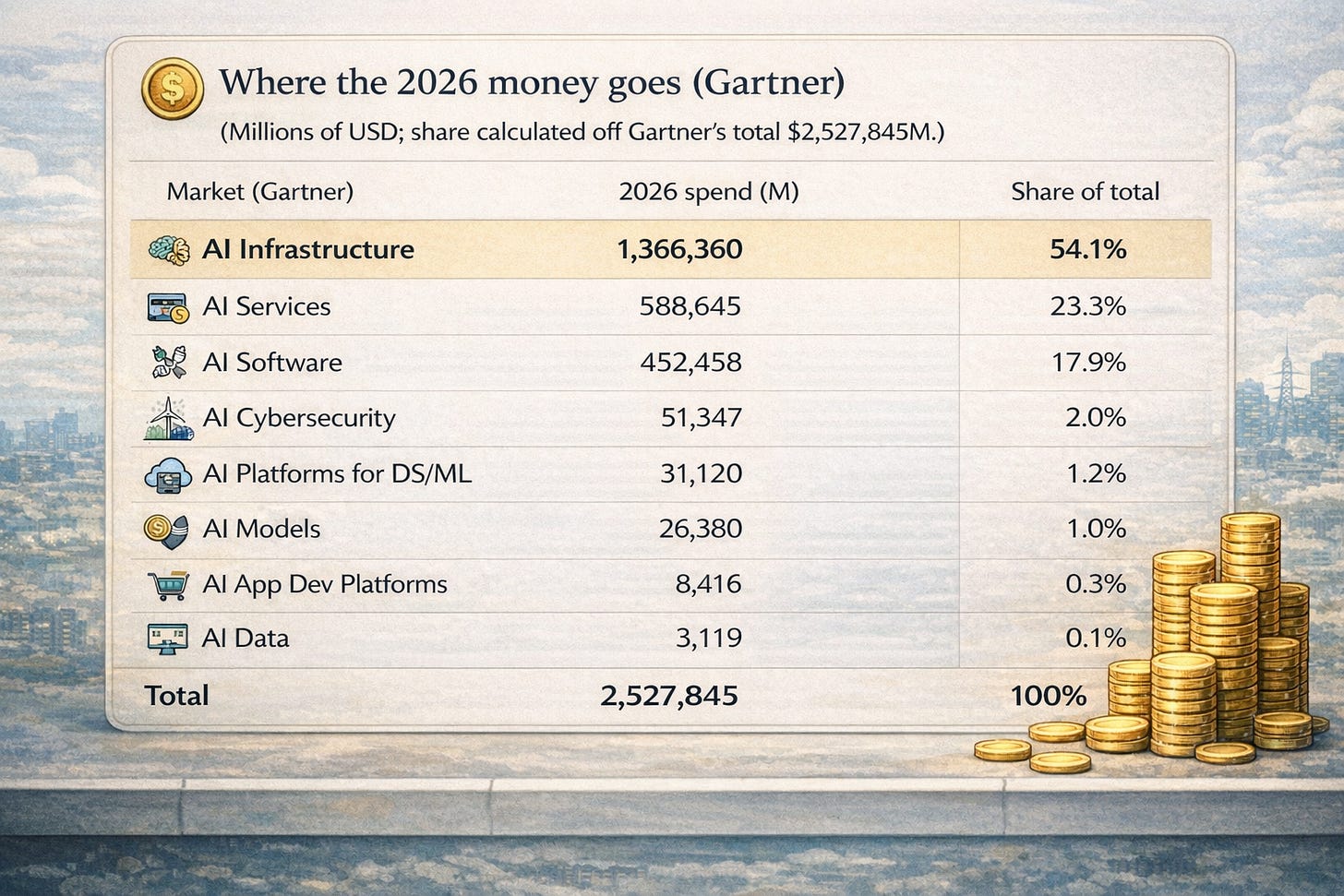

Global AI spending is forecast at $2.52T in 2026, according to Gartner.

Microsoft reported $34.9B in capex in FY26 Q1, driven by cloud and AI demand; its CFO also described roughly half going to CPUs/GPUs and the rest to long-lived data center assets.

Meta said it planned $60B–$65B in 2025 capex to expand AI infrastructure.

Amazon announced up to $50B to expand AI and supercomputing capacity for AWS U.S. government customers, breaking ground in 2026, adding nearly 1.3 gigawatts of capacity.

All of this is “hard to reverse” spending. It is not a consumer app trend you can walk away from in a quarter.

If you want a single takeaway from this table: more than half of AI spending is infrastructure, and the next biggest chunk is services.

Pillar 2 – AI stops being a discretionary experiment

Bubbles usually unwind cleanly when the thing being funded is optional. When budgets tighten, companies can walk away without operational pain. That’s not how AI is behaving inside serious organizations. It’s moving from “pilot projects” into core productivity and execution. Companies might cut vanity experiments, but they keep what helps teams do more with the same headcount.

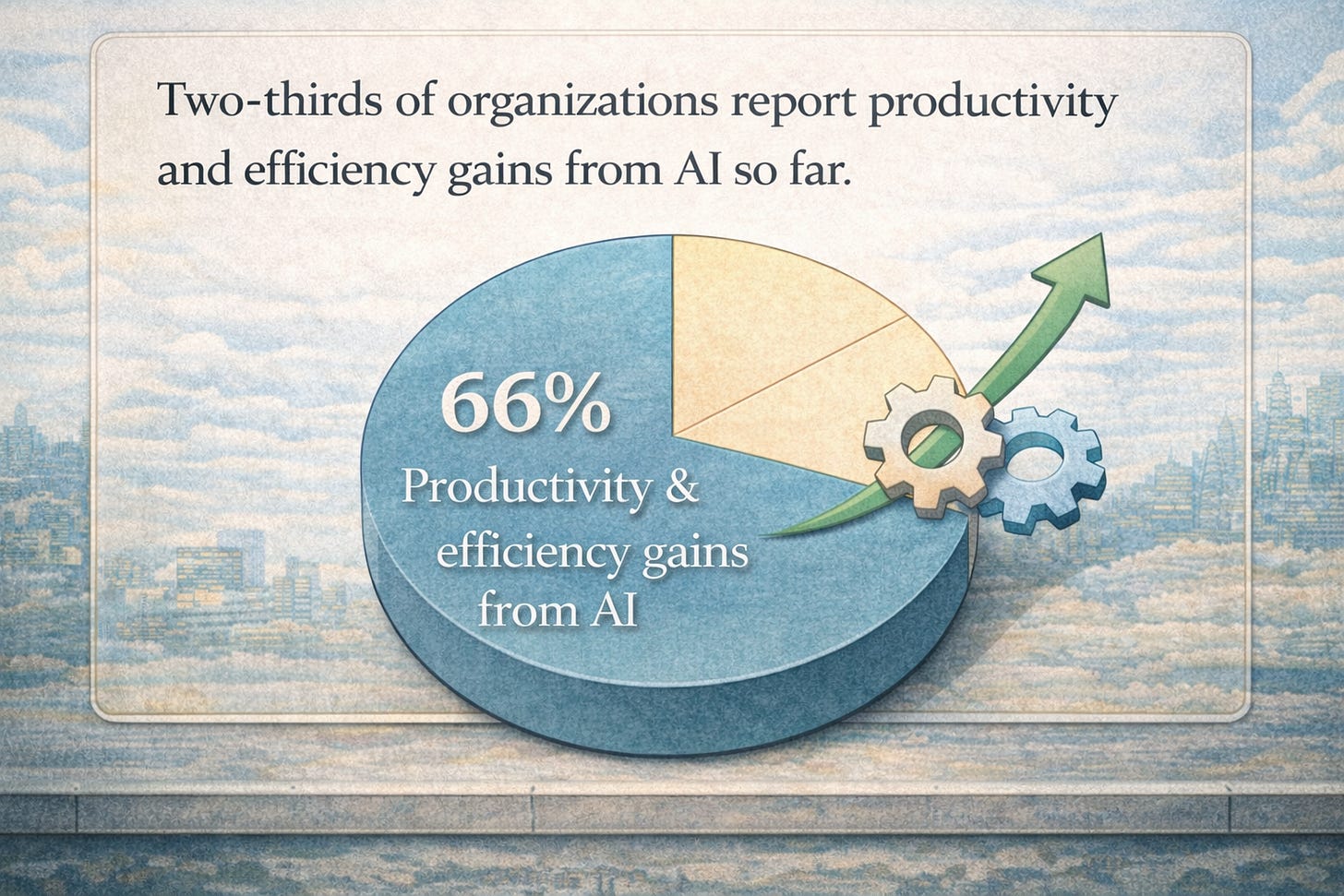

Deloitte’s 2026 enterprise survey is a useful snapshot here: two-thirds (66%) of organizations report productivity and efficiency gains from AI so far.

That so far implies AI is already getting defended as operations, not novelty. And the way companies talk about it is shifting: fewer announcements; more “this reduces cycle time,” “this lowers ticket volume,” “this helps engineers ship.”

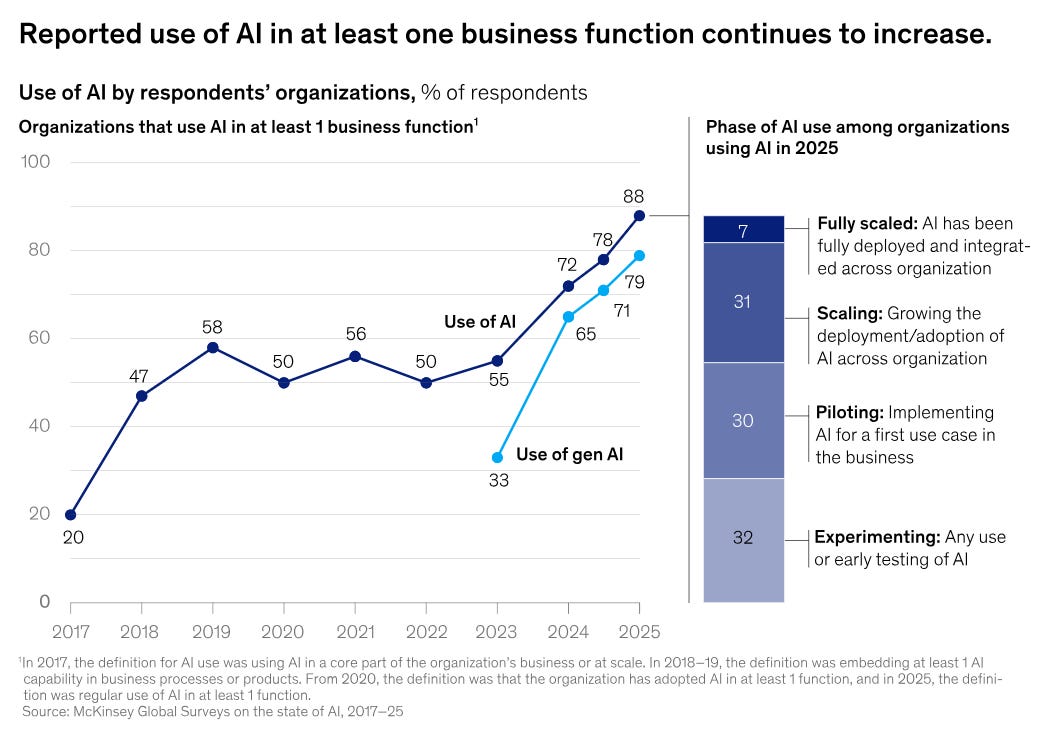

McKinsey’s 2025 State of AI survey points to the same direction at scale: 88% of respondents reported regular use of AI in at least one business function (up from 78% the prior year).

So if 2026 looks like “AI budgets are getting cut,” I’d bet a lot of that is actually re-pricing and re-allocation: fewer demos; more workflows. That can crush weak companies. It doesn’t require the category to implode.

Pillar 3 – Talent and capital aren’t going nowhere

A true bubble pops when the smartest builders and the most serious capital quietly leave. That doesn’t match what’s happening here.

The biggest players are still making commitments that lock them in for years, not months. Plus, the private market is still allocating aggressively into AI.

Crunchbase’s year-end data makes the point clearly: AI captured roughly ~50% of global venture funding in 2025, and AI funding reached about $211B (their reporting varies slightly by cut and methodology, but the direction is consistent).

Also, the capital is concentrating into infrastructure and frontier labs too. For example, Amazon has doubled down on Anthropic in a way that looks structural, not opportunistic: Amazon’s total investment in Anthropic reached $8B through its expanded partnership.

This is what a rotation looks like: weaker “AI wrapper” products get squeezed; deeper infrastructure, models, and workflow companies keep getting funded and adopted.

Again, that’s capitalism doing what it always does: raising the bar and clearing out weak (business) models.

So what do you do with this if you’re building in AI?

Go into 2026 expecting the bar to rise in a very boring way that shows up in longer sales cycles, louder procurement, more security reviews, and more people asking for proof earlier.

Buyers will still spend, but they’ll ask harder questions and they’ll take longer to commit. The tools that survive this phase are usually the ones that reduce work instead of adding steps, and the ones that are easy to defend in a budget conversation.

In practice, the teams that hold up tend to share a few traits: the ROI is easy to explain, the product sits inside real workflows, and the plan doesn’t assume fundraising will land exactly when you need it.

If the market gets choppier, this keeps you alive. If it doesn’t, you still end up with a better business.

CONCLUSION

Thank you, Laura Ferraz Baick!!

So, which argument won you over?

Did the revenue gap, valuation risks, and capital crunch make you think we’re heading for a correction? Or does Laura’s case (that AI is too embedded in enterprise operations to experience a full collapse) feel more realistic?

Here’s the thing: I set up this debate because I wanted you to see both sides clearly. But I also owe you honesty about where I actually land.

I don’t think there’s a bubble that will pop.

I think 2026 will be messy. Some AI companies will absolutely get crushed. Valuations will reset. The hype tourists will leave. But the core AI economy (the infrastructure, the embedded workflows, the capital that’s already locked in) isn’t going anywhere.

Why did I argue the “yes, bubble” side if I don’t believe it? Because the best way to understand your own position is to steel-man the opposing argument. And the concerns about revenue gaps, funding constraints, and technical limits are real. They deserve serious consideration, not dismissal.

What I believe is this:

AI isn’t going to crash because it’s already too foundational. We’re not betting on AI anymore. We’re building our economic infrastructure on top of it. That doesn’t mean every AI stock is a good investment. It means the question isn’t “will AI survive?” but “which parts of AI will compound, and which parts were always just noise?”

Now I want to hear from you:

Which argument resonated more? Are you preparing for a correction, doubling down on AI infrastructure, or waiting to see how 2026 plays out?

Drop your thoughts in the comments. Let’s keep this debate going.

Join 3,500+ Leaders Implementing AI today…

Which Sounds Like You?

“I need systems, not just ideas” → Join Premium (Starting at $39/yr, $1,345+ value): Tested prompts, frameworks, direct coaching access. Start here

“I need this built for my context” → AI coaching, custom Second Brain setup, strategy audits. Message me or book a free call

“I want to reach these leaders” → Sponsor one post (short supply). 3,500+ executives. Check availability

PS: Many subscribers get their Premium membership reimbursed through their company’s professional development $. Use this template to request yours.

“Why did I argue the “yes, bubble” side if I don’t believe it? Because the best way to understand your own position is to steel-man the opposing argument.”

100% on of the best more general pieces of advice and takeaways here. thanks for the read, enjoyed this one.

If I were to sum up my thoughts in three words: sunk cost fallacy.